The Reality of Disability and Disability Insurance

The Reality of Disability For many, disability insurance is overlooked as a fundamental strategy for financial security. However, there are myriad reasons to think again. Continued economic volatility. Rising home foreclosures. Eroded retirement accounts. Stubbornly...

Life Settlement: An Often Overlooked Idea

What is a Life Settlement? A life settlement is the sale of a life insurance policy to a third party called a life settlement provider. The owner of the life insurance policy sells the policy to the settlement provider and receives an immediate payment in return. The...

Term or Permanent Life Insurance?

"Term or permanent life insurance?" One of the most frequently asked questions we are asked is, "Which one should I consider?" Term insurance usually provides the largest amount of insurance protection at the lowest initial cost. For this reason, it's the type most...

When Life Insurance Provides Value

Here are some of the areas in which life insurance provides value: Estate Settlement Costs. Expenses can begin before death (such as medical and hospital expenses, nursing home expenses, physical therapy, and drug costs) and continue for several years (probate costs,...

Life Insurance Strategies and All the Single Parents…

Life insurance strategies may not be top of mind for a very busy single parent. Whether you are or expect to become a single parent however, here is a checklist of major challenges and decisions the merit a look at your life insurance strategies: Set up a budget and...

Underwriting Factors: What is Considered?

Underwriting factors are often a mystery for the general public. "Why is my life insurance premium so expensive?" Of course, you want to know what influences the rates that you incur in purchasing life insurance. Your curiosity is natural. We all want to find ways to...

Should You Cash In Life Insurance Policies in Tough Economies?

Should you cash in life insurance policies when you need the money? When the United States was facing what the Federal Reserve has described as an “unusually gradual and prolonged” period of recovery, the nation’s economic outlook was somber, and many families were...

Long-Term Business Planning Strategies and Success

Long-term business planning can ensure and extend the success and profitability of a business, and protect hard-earned equity. As a business owner, you engage in a variety of planning activities to produce and market a product or service and expand the business. At...

The Beneficiary is…

The beneficiary is not always clear to family members when a life insurance policy is settled. We recently came across an article on NJ.com offering advice on the unfortunate situation when the insurance for a deceased loved one has a beneficiary who himself/herself...

5 Ways Your Social Media Increases Insurance Rates

What? Social Media increases insurance rates? We all love social media. The constant “Which F.R.I.E.N.D.S Character Are You Quizzes?” The spirited debates about whether quinoa is actually worth eating. The quotes by Mother Theresa that are actually by Britney Spears....

National Life Insurance Policy Locator Service Finds Lost Benefits

Current News: Over $17 Million in Life Insurance Benefits Located for Tennesseans The Tennessee Department of Commerce and Insurance (TDCI) announced that over $17.5 million in life insurance benefits have been located for Tennesseans since Jan. 1, 2019. The National...

Famous Estate Planning Failures

NAME: Audrey Hepburn DIED: January 20, 1993 AGE: 63 CAUSE: Cancer ESTATE BLUNDER: Leaving her sons to split the contents of her storage locker 50/50 without clear instruction. In her handwritten Will, Audrey Hepburn left her notable possessions to her sons to be split...

5 Ways Life Insurance in Retirement Can Help

There are ways Life Insurance in Retirement can provide advantages to your planning and security. As retirement draws near, it’s only natural to look at your life insurance coverage and wonder whether any changes should be made. After all, you might have first...

Annuities in 401(k) Plans

The Underwriter's Corner: Underwriting Q & A Current News: New Bill Would Allow More Annuities in 401(k) Plans The SECURE Act is one step closer to becoming law, and with it, Americans would see a few tweaks to the way the retirement system works. As part of the...

Deferred Annuities and the Rolling Stones

The Underwriter's Corner: Underwriting Q & A Current News: The Rolling Stones Know What You Need: An Annuity So it’s come to this: deferred annuities and rock ’n’ roll. We’d like to believe that the Stones are as ageless as Peter Pan, but it turns out that the...

Why Disability Insurance?

6 Advantages of Disability Insurance “Why should I get disability insurance? If I already have life insurance, isn’t that enough to keep me covered in case anything happens?” You might have heard friends and colleagues express this sentiment in the past–and you...

More Estate Planning Blunders

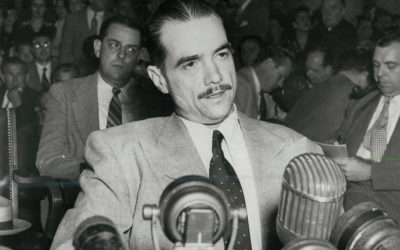

Famous Estate Planning Failures NAME: Howard HughesDIED: April 5, 1976AGE: 70CAUSE: Kidney failure ESTATE BLUNDER: Not leaving behind a will. Over his lifetime, Howard Hughes’ wallet became one of the fattest of his time. When he died, there was one major problem:...

Life Insurance for Retirement Planning

Retirement Planning and How Life Insurance Can Help You “Life insurance is what you buy when you think you’re going to die so that your kids don’t have to pay for your funeral, right?” There are a lot of misconceptions in the financial world, but life insurance...

What is Universal Life Insurance?

What Is Universal Life Insurance and How Does It Work? Life insurance protects you against both the inevitable and the unforeseen. Whether it is a sudden tragedy or the simple reality of death and taxes, coverage helps your family to pay for post-mortem bills,...

What Factors Impact the Cost of Life Insurance?

The Cost of Life Insurance Depends On 8 Major Factors Here is a simple question to decide whether you need life insurance: Does anyone rely on your income for their financial well-being? That could be children, a spouse, aging parents, or anyone else who could be...

Do You Have Life Insurance?

The Underwriter's Corner: Underwriting Q & A Current News: New Study Says 40% of U.S. Adults Don’t Have or Don’t Know If They Have Life Insurance Employee benefits provider Unum finds that 38% of U.S. adults rate their ability to manage finances as average, poor,...

Why Life Insurance? Ask Brooke Shields

Current News: Brooke Shields Explains Why Life Insurance Is Essential To Have September was Life Insurance Awareness Month, and Brooke Shields partnered with nonprofit Life Happens to deliver a critical message: Each and every family should, and can, protect their...

More Advisors Boost Fixed Income with Life Insurance and Annuity Products

Economic and demographic shifts are making life insurance and annuities more attractive options to boost fixed income, financial advisors say. “In a typical 60/40 portfolio, because bond returns are at a 50-year low, I’m seeing people moving funds from bonds to either...

Hybrid Life Insurance Policies Popular As Long-Term Care Funding Strategy

While traditional stand-alone long-term care insurance (LTC) products have seen a drop in popularity in the past several years, life insurance-backed long-term care funding strategies have experienced tremendous growth. In 2017, life-LTC hybrid policies increased by...

What is an Accelerated Death-Benefit Rider?

The more common type of benefit on existing life insurance policies is the accelerated death-benefit rider. These riders often have no additional up-front charge and are just included as part of the policy; however, this is not always the case, as some policies do...

Technology and Insurance Rates

Access to Digital Data is Revolutionizing Life Insurance Underwriting Technology and insurance rates are creating a new and sometimes complex dynamic in the insurance world. Coupled with automation, access to data such as electronic medical records, health claims...

Choosing a Life Insurance Beneficiary

A life insurance beneficiary is the person or entity you name in a life insurance policy to receive the death benefit. You can name: One personTwo or more peopleThe trustee of a trust you’ve set upA charityYour estate If you don’t name a beneficiary, the death benefit...

Life Insurance: A Versatile, Multi-Purpose Financial Asset

Life insurance can be a valuable and versatile financial asset that may be able to help individuals and families deal with a variety of financial problems. One of life insurance’s biggest advantages is its flexibility. Policies can provide benefits for a limited...

Indexed Universal Life Insurance Continues Growth Streak

Indexed universal life insurance sales are up double digits as market conditions drive the product line to its eighth consecutive quarter of growth in premiums, according to insurance industry group LIMRA. Indexed Universal Life (IUL) insurance sales rose 10% in the...

Famous Estate Planning Failures

Estate Planning failures are not only for the wealthy. Nor do you need to be famous like our friends below to fall into the trap of poor planning and faulty thinking. Read about these famous estate planning failures and take heed! NAME: Glen Campbell DIED: August 8,...

Disability Solutions Unavailable in Traditional U.S. Insurance Markets

Shortfalls of Traditional Disability Insurance Markets There are disability solutions unavailable in the U.S. market which can still be leveraged by U.S. citizens. The following is a glimpse into the less common ways in which disability solutions are meeting real...

Premium Financing through Life Insurance

Announcing Premium Financing available now. The Ziff Agency, LLC is proud to offer an alternative method of purchasing life insurance to qualified candidates exclusively through its relationships with national lending institutions. The Ziff Agency is nationwide and is...

Many Long-Term Healthcare Planning Options are Available

Long-term healthcare planning is critical for security and peace of mind. Approximately two-thirds of Americans age 65 or older will need some type of long-term care with the average length of time being approximately three years. In New Jersey, the average cost of a...

LIFE INSURANCE ANALYSIS in 5 Steps

How often should I conduct a life insurance analysis? Although most individuals probably review their financial goals and investments on a regular basis, far fewer examine their life insurance coverage to determine if it is still meeting their needs. A thorough review...

Joint Life Insurance for Married Couples

Are you married? A joint life insurance policy can save you money and keep your family financially secure in if either one of you die. To find the best deal, comparison shop because there are many different companies and options on the market, and their terms and...

Will Wearable Devices Make Us Healthier?

Wearable devices, like that smartphone and the apps you love to use to track your daily runs, could impact your health in a good way. Apple, the giant electronics firm that launched the first smartphone wearable device, activated an intriguing new feature on its watch...