Yes, you need disability insurance part as your financial security portfolio. If you think that you would never need this type of coverage, consider these facts:

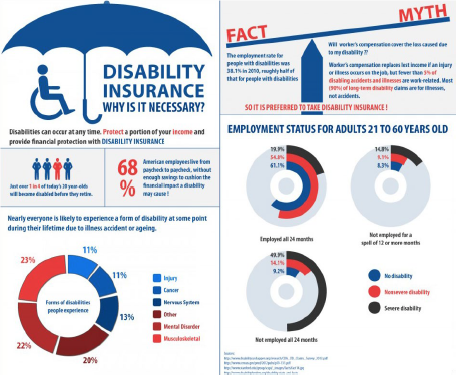

- Just over 1 in 4 of today’s 30-year-olds will become disabled before they retire.

- Additionally, research has shown that one-third of employed Americans will become disabled for at least 90 days at some point in their career.

- Fewer than 5% of disabling accidents or illnesses are work-related and therefore, do not qualify for workers’ compensation insurance.

- The average disability claim lasts almost 13 months.

- Mortgage foreclosures due to disability occur 16 times as often as they do for death.

- 68% of American employees live paycheck to paycheck and have not been able to accumulate a financial cushion on which to ride out a short-term disability, much less a long-term disability.

- 40 percent of full-time workers do not have coverage in the event of a short- or long-term disability to protect against a loss of income.

What is Disability Insurance?

Disability insurance provides a source of income to people who are unable to work due to an accident or illness. It comes in a variety of shapes and sizes. Consider these broad categories:

Long-term disability insurance

Short-term disability insurance

Mortgage disability insurance

Supplemental disability insurance

Social Security disability insurance

State disability insurance

While some employers provide disability coverage, it is generally short-term and may replace only a small portion of a worker’s salary. In addition, if the employer pays for coverage, benefits are taxable. Adequate disability policies generally need to be purchased individually from an insurance agent.

The best advice for you is to work with an independent insurance expert who can research and vet a variety of policies from many carriers to find a policy that fits your needs and budget.

Insurance for the Self-Employed

Earning power is one of your greatest financial assets. If you are self-employed or an entrepreneur, a disability can hit hard if you are unable to continue running or managing your business. You need disability insurance as much as the average worker. The average worker and their dependents are too often living on the edge without coverage and at risk of losing their homes and wiping out retirement. Even the most successful entrepreneur remains at risk without sufficient disability coverage, which is a fundamental financial error.

Financial experts will agree you need disability insurance and generally advise purchasing a policy to replace about two-thirds (60 percent to 70 percent) of a worker’s monthly income. Insurance companies usually don’t provide coverage above this or it would discourage people from returning to work.

Two key features of disability insurance, that greatly influence its cost, are the definition of disability and the elimination period. “Own occupation” policies are more expensive because they kick in when you are unable to perform duties of the job for which you are trained — which means, even if you’re still able to do other types of jobs, but you are not able to do your chosen profession, then you can collect on the disability insurance. On the other hand, “any occupation” coverage defines disability as the inability to do any type of work. Many insurers also offer “split definition” policies that use an “own occupation” definition for several years, followed by an “any occupation” definition later on.

Costs and Fine Print

The elimination (waiting) period is the number of days after a disability begins before benefits are paid. The longer the elimination period (for example, 90 days versus 30 days), the lower the premium for a specified amount (for example, $1,500 a month) of disability insurance.

Read the fine print. Look for a disability insurance policy that is non-cancelable or guaranteed renewable and pays residual benefits to make up for lost income when a worker is unable to work at full capacity. For example, if an insured person goes back to work three days a week at 60 percent of full pay, the benefit would be prorated to reflect the actual amount of income lost.

Review the recurrent disability clause that describes what happens if an insured person becomes disabled again from a preexisting disability. For example, if someone becomes disabled again from the same cause, say, within six months of returning to work, they may not have to wait for another elimination period.

Consider purchasing a cost-of-living rider to protect the purchasing power of monthly benefits. Also check provisions related to disability benefits provided by an employer disability policy or Social Security. Sometimes income from these sources will be considered part of the policy benefit.

By now, we hope you can agree that you need disability insurance if it is not already part of your financial planning. The independent insurance experts at The Ziff Agency are ready to help you sift through the many options to find your fit. Contact us directly for your estimate.